Your Cart is Empty

YOUR CART

Your cart is empty!

Add your favorite items to your cart.

FSA /HSA Program

Pay for MedCline products with your health savings plan.

At MedCline, we believe a pain free night’s sleep is priceless ...and with your FSA/HSA savings account, it might just be.

PAY WITH FSA / HSA FUNDS

Our Sleep Systems are covered by most FSA and HSA plans* and can be purchased on our site using your plan-issued debit card.

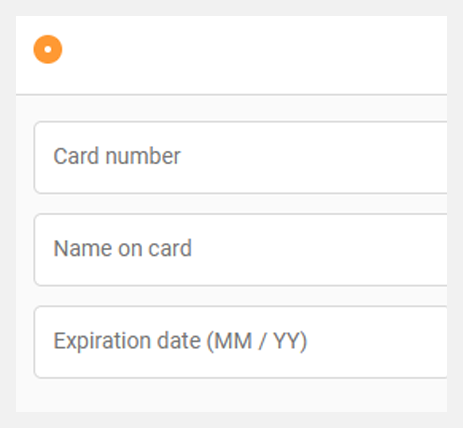

It’s easy Just enter your FSA/HSA debit card number during checkout.

SHOP NOW

SHOP NOWSPLIT YOUR PAYMENT

Don't lose sleep if your FSA/HSA savings account is a little light.

If you’d like to split your payment between your FSA/HSA debit card AND another payment type, we can help you with that over the phone.

Give us a call at 1-800-610-1607 and one of our amazing sleep specialist will be happy to help, or

Set up a callback time We can call you at a time that works with your schedule.

SCHEDULE A CALL